Last week saw important monetary decisions and economic releases worldwide. In the United States, the Federal Reserve decided to keep interest rates unchanged at 4.25%-4.50%, while retail sales data came in weaker than expected at 0.2%, and the Empire State index sharply dropped to -20 points. On the positive side, industrial production rose by 0.7%, and existing home sales improved to 4.26 million. In the Eurozone, annual inflation slowed to 2.3%, which was lower than expected, while in the UK, the Bank of England held rates at 4.50%, with wage growth declining to 5.8%. In Switzerland, the Swiss National Bank cut rates by 25 basis points to 0.25%. In Canada, retail sales dropped by -0.6%, while Australia recorded a loss of 52.8 thousand jobs, which was worse than expected. In Japan, the central bank kept rates at 0.5%, while export growth slowed to 11.4%, and national inflation decreased to 3.7%. In China, the People’s Bank of China kept lending rates unchanged at 3.10% for one year and 3.60% for five years, as expected.

Market Analysis

USD/CHF

The USD/CHF pair continues its upward trend, reaching 0.8840 on Friday, March 21, 2025. However, the USD/CHF pair is still down by around 3% since the beginning of the year. The Relative Strength Index (RSI) is currently around 41, indicating negative momentum for the USD/CHF pair.

Bitcoin

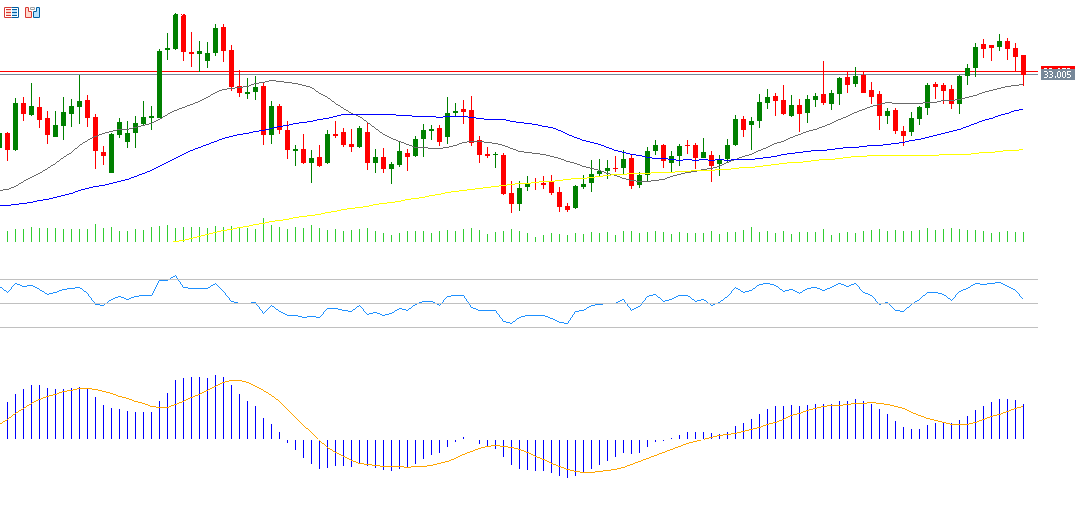

Bitcoin has been trading within a sideways range between $77,000 and $87,000 for the past two weeks, searching for a clear direction either upward or downward. The RSI currently stands at around 48, indicating negative momentum for Bitcoin. On the other hand, the MACD indicator shows a bullish crossover between the blue MACD line and the orange Signal line, providing positive momentum for Bitcoin.

Silver

Silver prices reached $34.24 last week, the highest level since October 30, 2024, thanks to the record rise in gold prices, expectations of further U.S. interest rate cuts, and ongoing geopolitical tensions in the Middle East and trade wars. The RSI is currently around 54, indicating positive momentum for silver.

DAX German Index

The DAX German index continues to set record highs, reaching 23,241 points last week, its highest level ever. It is up by about 15% since the beginning of the year, outperforming the French CAC40 index, the UK’s FTSE 100 index, the European STOXX600 index, and even U.S. stock indices such as the S&P 500 and Nasdaq 100. The RSI is currently around 54, indicating bullish momentum for the DAX.

Key Events This Week

Markets are looking forward to several important indicators and economic data this week:

• Today, the Purchasing Managers’ Index (PMI) for manufacturing and services will be released for Australia, Japan, the UK, the Eurozone, and the U.S.

• On Tuesday, markets are awaiting the release of U.S. new home sales and consumer confidence indices.

• On Wednesday, markets will focus on the U.K. Consumer Price Index (CPI), as well as the U.S. durable goods orders and crude oil inventories.

• On Thursday, markets are expecting data on U.S. Gross Domestic Product (GDP), unemployment claims, and pending home sales.

• Finally, on Friday, the Tokyo CPI, U.K. GDP, U.K. retail sales, Canada’s GDP, and the U.S. Personal Consumption Expenditures (PCE) index and Michigan Consumer Confidence will be released.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.